Option Trading Strategy and the New Trend 2023

Introduction

Option trading is a financial instrument that has gained significant attention in recent years due to its potential for higher returns compared to traditional investment strategies. An option is a contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price within a specific time frame. Options can be used to hedge against potential losses or to take advantage of market volatility.

This report aims to provide an in-depth analysis of recent trends in options trading strategy. Specifically, will discuss the types of options trading strategies, recent trends in options trading strategy, the impact of technology on options trading, the future of options trading, options trading risks and challenges, and strategies for managing options trading risks.

Types of Options Trading Strategies

There are several options trading strategies that traders can use to maximise their returns and minimise their risk exposure. Some of the most popular options trading strategies include options spreads, covered calls, protective puts, and straddles and strangles.

Options spreads involve buying and selling multiple options contracts at the same time to limit risk and increase potential profits. There are two types of options spreads: vertical spreads and horizontal spreads. A vertical spread involves buying and selling options contracts with different strike prices, while a horizontal spread involves buying and selling options contracts with different expiration dates.

Covered calls involve selling a call option on an asset that the trader already owns. This allows the trader to generate income from the sale of the call option while still holding onto their underlying asset. Protective puts involve buying a put option on an asset that the trader already owns. This allows the trader to limit their potential losses if the market price of the asset falls.

As per risk preference and our usual strategies, we will highlight the volatility strategies. They are straddles, naked options and delta neutral.

Straddles involve buying both a call option and a put option on an asset with the same strike price and expiration date. This allows the trader to take advantage of market movements in either direction. Strangles involve buying both a call option and a put option on an asset with different strike prices but the same expiration date. This allows the trader to take advantage of market movements within a specific price range.

Naked put/call is a strategy to primarily capitalise the option’s premium base on the predict of the underlying asset may increase/decrease or with a little change. A naked put option strategy assumes that the underlying security will fluctuate in value, but generally rise over the next month or so. Based on this assumption, a trader executes the strategy by selling a put option with no corresponding short position in their account. Writing put/call is usually a strategy to short volatility when a trader thinks the IV is overvalued.

Delta neutral is a portfolio strategy utilising multiple positions with balancing positive and negative deltas so that the overall delta of the assets in question totals zero. Delta neutralisation is normally a portfolio rebalancing method in straddle, which deltas out any factors outside volatility but increase costs such as commission, labour.

Recent Trends in Options Trading Strategy

To start 2023, the equity market has rallied and options volume continues to increase, setting an all-time single-day record of 64.8mm multi-list contracts traded. Much of the options market usage we observed has reflected concurrent equity index activity, but examining the market by flow type reveals some variations in bullishness and bearishness from different types of investors.

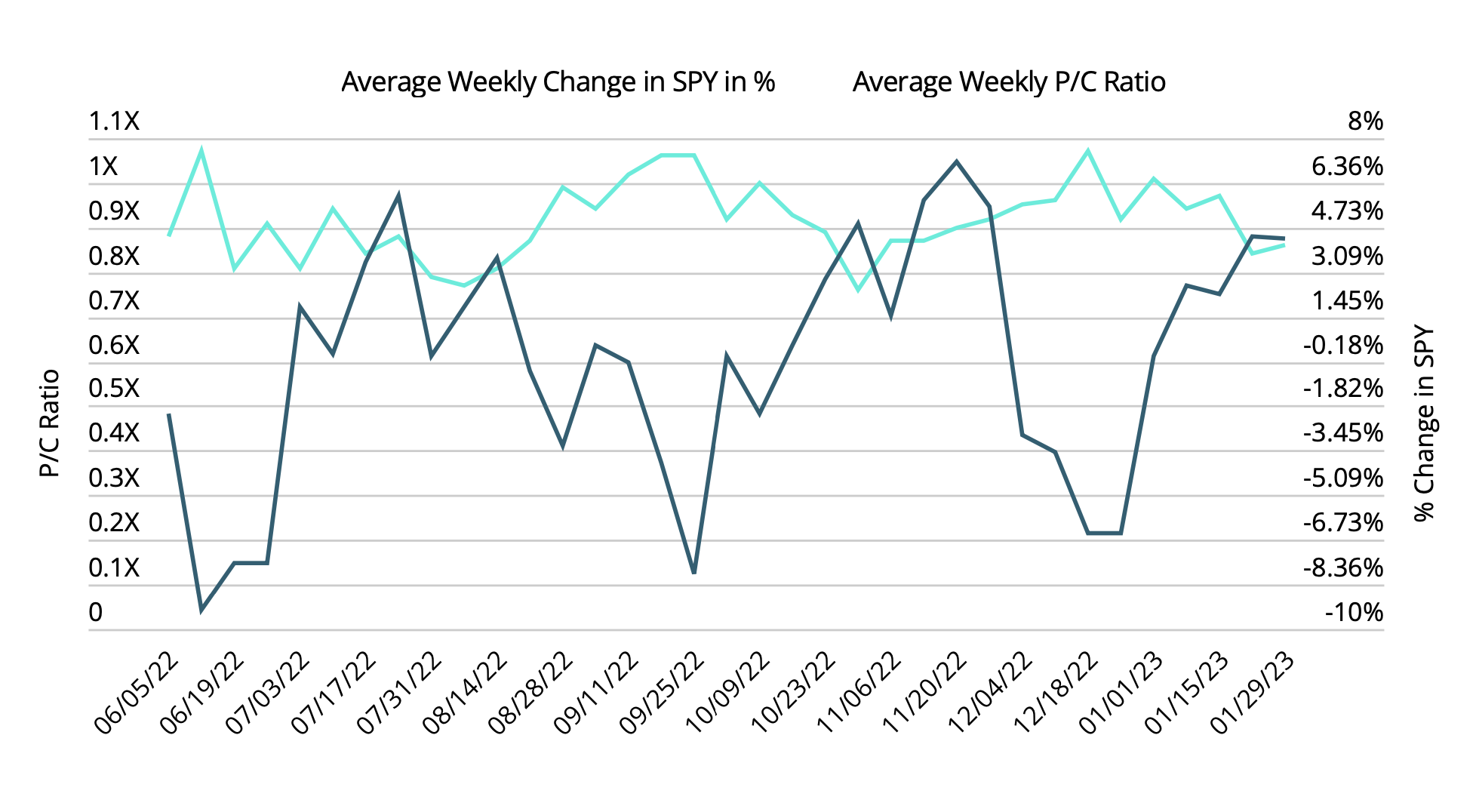

This figure generally represents that option put/call ratio has negative relations to equity performance. As expected, this trend suggests much options activity aligned with the overall equity market moves.

In recent years, several trends in options trading strategy have emerged. These trends include increased use of options spreads, algorithmic trading, emergence of new trading platforms and services, increased interest in cryptocurrency options trading.

Increased use of options spreads has become popular among traders in recent years due to the fact that options spreads allow traders to limit their potential losses while still taking advantage of market movements. Algorithmic trading has become increasingly popular in the options trading market, involving the use of computer programs to automatically execute trades based on pre-determined criteria. Emergence of new trading platforms and services has occurred due to the popularity of options trading. Increased interest in cryptocurrency options trading has occurred due to the growth of the cryptocurrency market.

Impact of Technology on Options Trading

Technology has had a significant impact on the options trading market in recent years. This impact includes increased access to information, automation of trading processes, increased efficiency, increased competition, and increased innovation in trading platforms and services.

Increased access to information has allowed traders to access real-time market data, news, and analysis, enabling them to make informed decisions about their trades. Automation of trading processes has led to the development of new trading platforms and services that make it easier for traders to execute trades more efficiently. Increased efficiency has made the options trading market more efficient, resulting in faster trade execution times, lower transaction costs, and improved risk management. Increased competition has led to the development of new tools and resources to help traders make informed decisions and execute trades more efficiently. Increased innovation in trading platforms and services has resulted in the development of new trading tools and resources to help traders make informed decisions and execute trades more efficiently.

Practical Application on Options Trading

As the per member’s preference, we apply options trading mainly on taking advantage on volatility. When choosing strike prices, at the money has most of time value, while out of the money are cheapest. The first step is to choose trading strategy. With the risk reward ratio taking into consider, mean reversion and smile curve arbitrage are the main strategies we will discuss next. When investors notice the IV significantly over/under value, they can short/long IV with strategies we discussed in previous sectors (short straddle, short neutral, naked put).

Option arbitrage with smile curve is a trading strategy that involves exploiting the mispricing of options with different strike prices but the same expiration date. The smile curve refers to the shape of the implied volatility curve for options, which typically shows a smile-like shape, with higher implied volatility for out-of-the-money options and lower implied volatility for in-the-money options.

To execute option arbitrage with smile curve, traders typically use a combination of long and short positions in options with different strike prices. The goal is to profit from the difference in implied volatility between options with the same expiration date but different strike prices.

Also, here are the steps to execute option arbitrage with smile curve:

- Identify options with the same expiration date but different strike prices. Look for options with a significant difference in implied volatility between the out-of-the-money options and the in-the-money options.

- Create a long position in the out-of-the-money option with the higher implied volatility. This involves buying the option at the current market price.

- Create a short position in the in-the-money option with the lower implied volatility. This involves selling the option at the current market price.

- Monitor the market closely to ensure that the options remain mispriced. If the implied volatility for the options changes, it may be necessary to adjust the positions to maintain the arbitrage opportunity.

- When the options reach their expiration date, close out the positions to realize the profit.

It is important to note that option arbitrage with smile curve is a complex trading strategy that requires a deep understanding of options pricing and market dynamics. It is not suitable for inexperienced traders or those who are not familiar with options trading.

In addition, option arbitrage with smile curve involves significant risk, as changes in the underlying asset price or the volatility of the options can result in significant losses. Traders should carefully consider their risk tolerance and investment objectives before attempting this strategy.

Options Trading Risks and Challenges

While options trading can be a highly effective investment strategy, it is also associated with several risks and challenges. These risks and challenges include volatility risk, liquidity risk, counterparty risk and time decay risk.

Volatility risk is highly sensitive to market volatility, which means that traders are exposed to significant risk if the market experiences sudden and unexpected price movements. Liquidity risk can make it difficult for traders to execute trades at the desired price due to limited buyers or sellers for a particular options contract. Counterparty risk involves entering into contracts with counterparties, and if a counterparty defaults on their obligations, the trader may be exposed to significant losses. Time decay occurs because options contracts have a limited lifespan, which means that their value decreases over time. Also, complexity can make it difficult for traders to master the various types of options contracts and strategies.

Strategies for Managing Options Trading Risks

Although many risks involve option trading, there are several strategies that traders can use to manage options trading risks effectively. These strategies include diversification, hedging, and using risk management tools and resources.

First of all, investors need to understand the underlying assets they are looking for, judging by iv and other factors then choose a appropriate strategy. Diversification involves spreading investments across a range of different asset classes and markets, reducing the impact of market volatility on a trader’s portfolio. Hedging involves using options contracts to protect against potential losses, while risk management tools and resources can help traders make informed decisions and execute trades more efficiently.

The Future of Options Trading

The future of options trading is likely to be shaped by several key trends. These trends include increased use of artificial intelligence, expansion of cryptocurrency options trading, increased use of options trading in retirement accounts, continued innovation in trading platforms and services, and increased focus on environmental, social, and governance (ESG) factors.

Increased use of artificial intelligence is likely to play an increasingly important role in the options trading market in the future. This includes the use of machine learning algorithms to analyse market data and make trading decisions. Expansion of cryptocurrency options trading is likely to continue to expand in the future, as the cryptocurrency market continues to grow. Increased use of options trading in retirement accounts will require the development of new tools and resources to help investors manage the risks associated with options trading. Continued innovation in trading platforms and services will result in the development of new tools and resources to help traders make informed decisions and execute trades more efficiently. Increased focus on ESG factors will result in the incorporation of ESG metrics into options trading strategies.

Conclusion

In conclusion, options trading is a financial instrument that has gained significant attention in recent years due to its potential for higher returns compared to traditional investment strategies. There are several options trading strategies that traders can use to maximise their returns and minimise their risk exposure. Recent trends in options trading strategy include increased use of options spreads, algorithmic trading, use of options in retirement accounts, emergence of new trading platforms and services, and increased interest in cryptocurrency options trading. Technology has had a significant impact on the options trading market in recent years, resulting in increased access to information, automation of trading processes, increased efficiency, increased competition, and increased innovation in trading platforms and services. The future of options trading is likely to be shaped by increased use of artificial intelligence, expansion of cryptocurrency options trading, increased use of options trading in retirement accounts, continued innovation in trading platforms and services, and increased focus on ESG factors. While options trading can be a highly effective investment strategy, it is also associated with several risks and challenges. Traders can manage these risks effectively by using diversification, hedging, and risk management tools and resources.