US Inflation Terminal Value Prediction with Bayesian Learning

Introduction

Inflation is a critical macroeconomic indicator that plays a pivotal role in shaping the economic landscape of a nation. The United States, being one of the world’s largest economies, constantly strives to achieve stable and sustainable inflation rates to support economic growth, maintain price stability, and ensure the well-being of its citizens. The relationship between job and consumption data and inflation has long been a subject of interest and debate among economists. Job market conditions, such as employment levels, wage growth, and labor force participation, have a direct impact on consumers’ income and purchasing power. Concurrently, consumer spending, which drives a significant portion of the US economy.

The research will delve into the theoretical foundations and empirical studies that have explored the relationship between job and consumption data and inflation. It will examine key data, make predictions and analyse fliexbility and sensitivity of the economy in the next 1 to 2 year.

US Inflation Factors and Calculation Method

In June 2022, inflation in the United States accelerated and peaked at around 9%, its highest level since February 1982, as a result of soaring energy costs, labor mismatches, and supply disruptions. But inflation is not a new phenomenon; countries have weathered inflation throughout history.

Several factors influence the US inflation, which mostly includes in the measurement of CPI:

- Monetary Policy: The actions taken by the Federal Reserve to adjust interest rates, control money supply, and manage the economy impact inflation. Lower interest rates and expansionary monetary policies can stimulate spending and potentially increase inflation, while tighter monetary policies can aim to reduce inflationary pressures.

- Demand and Supply: The overall demand for goods and services in the economy, coupled with the available supply, plays a significant role in determining inflation. When demand outpaces supply, prices tend to rise, leading to inflationary pressures. Conversely, if supply exceeds demand, it may lead to lower prices or deflation.

- Labor Market Conditions: Wages and employment levels impact inflation. When there is low unemployment and strong demand for labor, wages tend to rise, increasing production costs for businesses. These increased costs may then be passed on to consumers, leading to inflationary pressures.

- Energy and Commodity Prices: Fluctuations in energy prices, such as oil and gas, as well as the prices of other key commodities, can influence inflation. Changes in these prices affect production costs for businesses, which may result in adjustments to consumer prices.

- Government Policies and Fiscal Measures: Government policies, such as taxation, subsidies, and regulations, can influence inflation. Fiscal measures, such as government spending and budget deficits, can impact the overall level of demand in the economy, potentially leading to inflationary pressures.

As Fed devoted to fight inflation and maintain price stability, central banks started the rates rising race. After increasing interest rate 10 times in a row, Fed finally decided a “skip” in June 2023. The “skip” is basically due to recent bank crsis and CPI decline.

The CPI is often reported as a percentage change from a reference period, indicating the inflation rate. Economists use CPI data to monitor inflation trends, make policy decisions, adjust wages and benefits, and assess the impact of inflation on the economy and households’ purchasing power. The statistics are normally including Selection of Basket of Goods, Price Data Collection, Headline Items, Services, Energy, etc. within CPI calculation.

| Seasonally adjusted changes from preceding month | Un- adjusted 12-mos. ended May 2023 |

|||||||

|---|---|---|---|---|---|---|---|---|

| Nov. 2022 |

Dec. 2022 |

Jan. 2023 |

Feb. 2023 |

Mar. 2023 |

Apr. 2023 |

May 2023 |

||

All items |

0.2 | 0.1 | 0.5 | 0.4 | 0.1 | 0.4 | 0.1 | 4.0 |

Food |

0.6 | 0.4 | 0.5 | 0.4 | 0.0 | 0.0 | 0.2 | 6.7 |

Food at home |

0.6 | 0.5 | 0.4 | 0.3 | -0.3 | -0.2 | 0.1 | 5.8 |

Food away from home(1) |

0.5 | 0.4 | 0.6 | 0.6 | 0.6 | 0.4 | 0.5 | 8.3 |

Energy |

-1.4 | -3.1 | 2.0 | -0.6 | -3.5 | 0.6 | -3.6 | -11.7 |

Energy commodities |

-2.1 | -7.2 | 1.9 | 0.5 | -4.6 | 2.7 | -5.6 | -20.4 |

Gasoline (all types) |

-2.3 | -7.0 | 2.4 | 1.0 | -4.6 | 3.0 | -5.6 | -19.7 |

Fuel oil(1) |

1.7 | -16.6 | -1.2 | -7.9 | -4.0 | -4.5 | -7.7 | -37.0 |

Energy services |

-0.6 | 1.9 | 2.1 | -1.7 | -2.3 | -1.7 | -1.4 | 1.6 |

Electricity |

0.5 | 1.3 | 0.5 | 0.5 | -0.7 | -0.7 | -1.0 | 5.9 |

Utility (piped) gas service |

-3.4 | 3.5 | 6.7 | -8.0 | -7.1 | -4.9 | -2.6 | -11.0 |

All items less food and energy |

0.3 | 0.4 | 0.4 | 0.5 | 0.4 | 0.4 | 0.4 | 5.3 |

Commodities less food and energy commodities |

-0.2 | -0.1 | 0.1 | 0.0 | 0.2 | 0.6 | 0.6 | 2.0 |

New vehicles |

0.5 | 0.6 | 0.2 | 0.2 | 0.4 | -0.2 | -0.1 | 4.7 |

Used cars and trucks |

-2.0 | -2.0 | -1.9 | -2.8 | -0.9 | 4.4 | 4.4 | -4.2 |

Apparel |

0.1 | 0.2 | 0.8 | 0.8 | 0.3 | 0.3 | 0.3 | 3.5 |

Medical care commodities(1) |

0.2 | 0.1 | 1.1 | 0.1 | 0.6 | 0.5 | 0.6 | 4.4 |

Services less energy services |

0.5 | 0.6 | 0.5 | 0.6 | 0.4 | 0.4 | 0.4 | 6.6 |

Shelter |

0.6 | 0.8 | 0.7 | 0.8 | 0.6 | 0.4 | 0.6 | 8.0 |

Transportation services |

0.3 | 0.6 | 0.9 | 1.1 | 1.4 | -0.2 | 0.8 | 10.2 |

Medical care services |

-0.5 | 0.3 | -0.7 | -0.7 | -0.5 | -0.1 | -0.1 | -0.1 |

|

Footnotes |

||||||||

Here above is the CPI data released by US Bureau of Labor Statistics at 13th of June. The index for shelter was the largest contributor to the monthly all items increase, followed by an increase in the index for used cars and trucks. The food index increased 0.2 percent in May after being unchanged in the previous 2 months. The index for food at home rose 0.1 percent over the month while the index for food away from home rose 0.5 percent. The energy index, in contrast, declined 3.6 percent in May as the major energy component indexes fell.

Based on the weight, persistance and impact, we will focus on the shelter (labor), food away and auto (consumer).

Quant (coef, sensitivity)

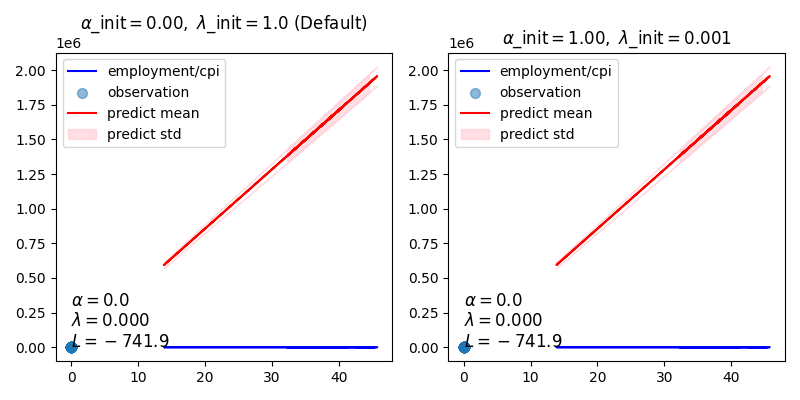

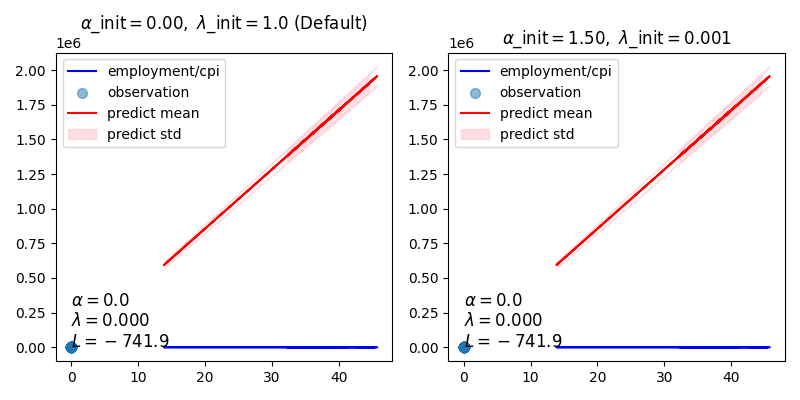

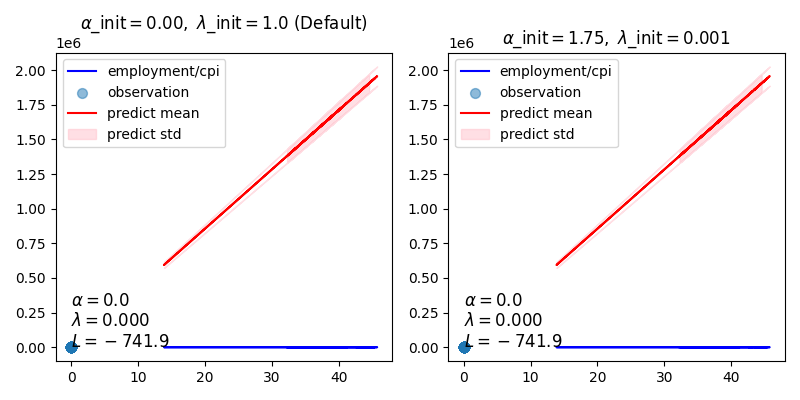

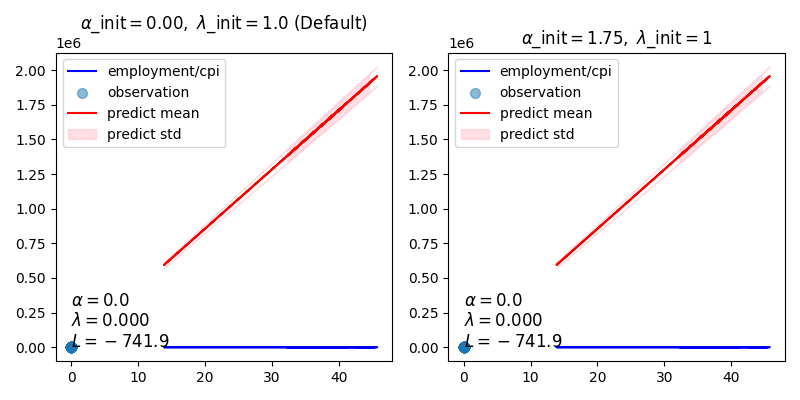

To predict the future trend of US inflation and understand the relationships between ecnomic data and inflation, we need to first estimate the coeficiency between labor, consumer and CPI. With the machine learning, we collected the data between 2013 and 2023, and put it to run in a machine learning BayesianRidge fitting test. The consumer and job data are used as training data set, while they seprately analysed as predict set.

With the result:

R square: 87.75429500104834

Slope: [0.01940615 3.8098487 ] (Job/consumer)

Intercept: 99.48466424568565

Predicted response:

[229.26361351 234.03735393 229.9032398 234.33723222 232.19437078

233.32572405 229.47446669 233.43602215 233.38337997 238.45683648

242.3111137 234.37774196 229.68380514 238.86666929 239.5959317

237.77830599 243.60513265 239.96090529 248.70507671 240.76258386

242.2459265 243.23330403 242.04279104 247.68835769 239.14206855

……………………………..

255.20443757 251.10885394 262.61126391 255.09781159 247.79216116

253.7513393 256.93403906 257.69089597 257.476193 261.48627715

266.50623011 268.89795852 270.74930181 272.77203262 269.04632847

271.3200653 277.40210706 275.50297793 275.22691572 276.47396304

275.75946459 274.44041848 275.18601152 273.72124508]

For the best fit we tested few arguments, with few stable predictions above.

With all the data, we now conduct a sensitivity analysis:

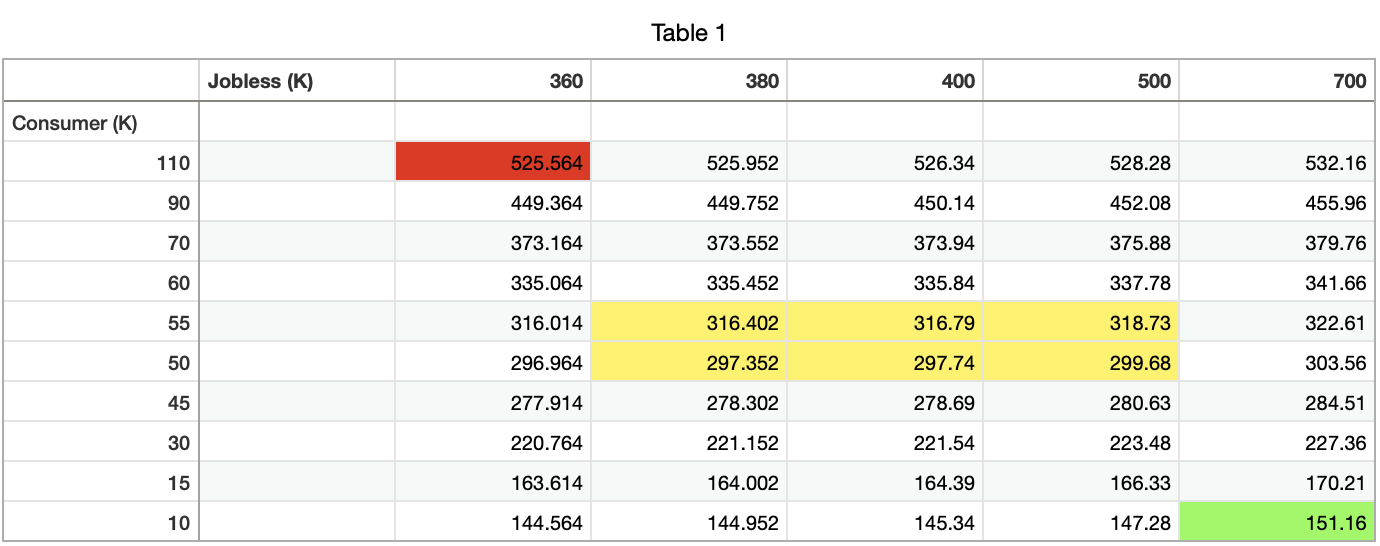

Take 316.402 as an example. As current CPI data (304.127) and average 2% MOM incremental speed, 304.127 * 1.002 ^ 20 = 316.52 will be the CPI in 20 months. Therefore, the YOY CPI at that time will be 316.52 / (304.127 * 1.002 ^ 8) - 1 = 2.42%.

Trading Strategy

The result shows that in an average economic environment, namely job data dims a bit from the current overheating market and supply chains catches up with the consumer, the CPI data in the next 1 - 2 year most likely will reach from 299.68 to 316.40 and YOY increase will maintain in the 2% range. Good news for long-term investors but can we monetise it?

Treasuries will obviously benefit from it based on the inflation trend and interest expectations. Then, the banking sector. Energy or tech might dip most with this going forward.

Investors could long bonds and long JPM. The most aggressive ones could also have long bonds and pair with writing TQQQ calls.