Bond Investment Thesis

The US Treasury Bond is one of the most widely watched fixed-income securities across the globe. It is considered a benchmark for the overall health of the US economy and is closely monitored by investors, traders, and economists alike. In this report, we will analyse the current market conditions and economic outlook to make a bullish case for investing in the US 10-year Treasury Bond.

The 10-year Treasury yield is closely watched as an indicator of broader investor confidence. Because Treasury bills, notes, and bonds carry the full backing of the U.S. government, they are viewed as one of the safest investments, which sometimes are viewed as the confidence of the market. The 10-year bond is also used as a proxy for mortgage rates in property and risk-free rates in the equity market. It’s therefore seen as a sign of investor sentiment about the economy.

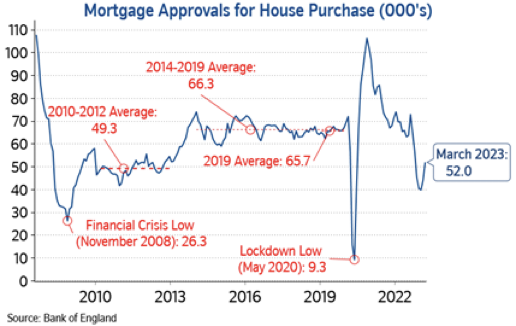

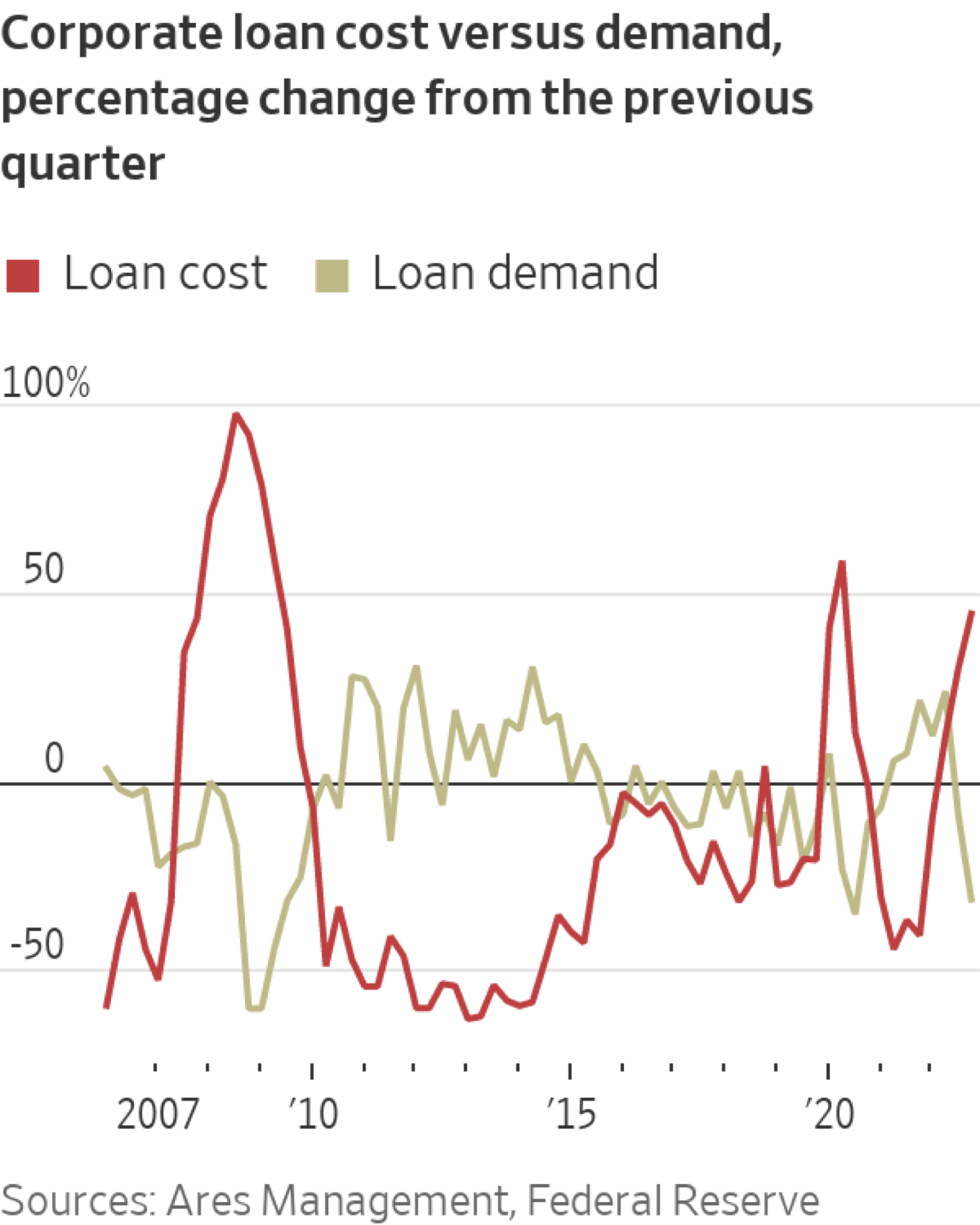

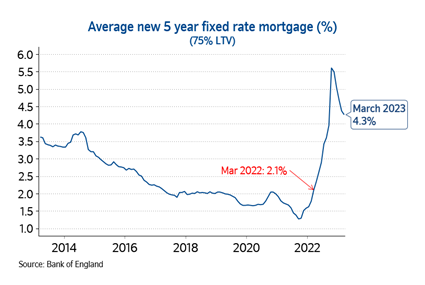

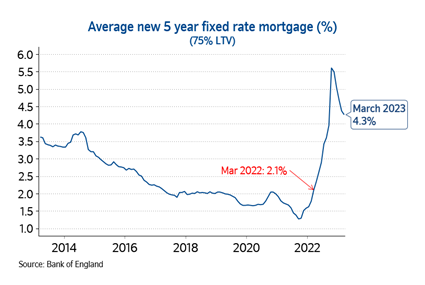

Based on the factors we discussed, with the Fed’s hawkish move in the last two years, the benchmark rate of the housing market and capital market both increased. A rising yield indicates falling demand for Treasury bonds, which means investors prefer higher-risk, higher-reward investments. A falling yield suggests the opposite. This also affects the property market largely. In the housing market, property price growth has been paused by the high mortgage rate. According to the data from BOE, the mortgage rate peaked at around 5.5% at the end of 2022 which is the highest in the last decades. Although the market started betting on optimisation in March based on the expectation of the central bank turning around and the economy soft-landing.

Before discussing specific bond trading strategies, it is important to understand the different types of bonds and their relationship with interest rates. Bonds can be classified based on their issuer, maturity, and credit quality. The most widely traded bond in the world is the US Treasury bond, which is backed by the full faith and credit of the US government. The 10-Year Treasury bond, in particular, has a maturity of 10 years, which is the specific bond our trading strategy will focus on later.

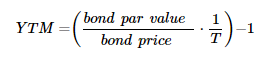

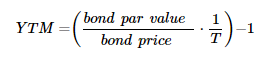

It is also important to understand some basic yield to maturity modelling method.

Yields Rise ▲ THEN Prices Fall ▼

Yields Fall ▼ THEN Prices Rise ▲

The model above states the basic bond pricing concept. Interest rates play a crucial role in bond trading. When interest rates rise, bond prices tend to fall, as investors demand higher yields to compensate for the opportunity cost of holding fixed-income securities. Conversely, when interest rates decline, bond prices generally rise.

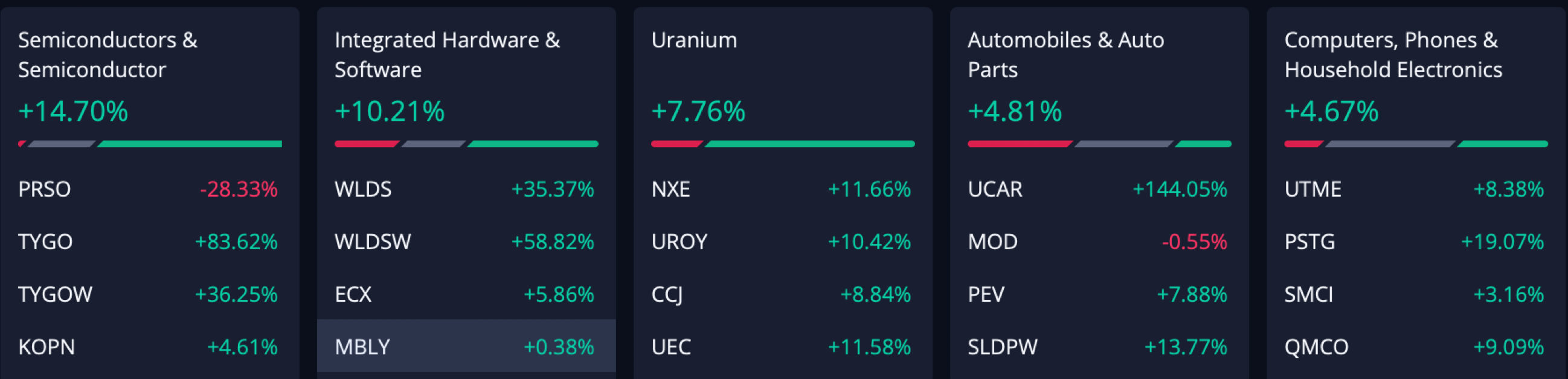

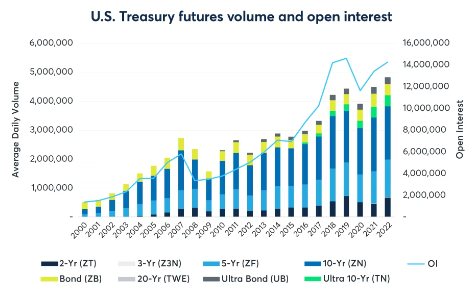

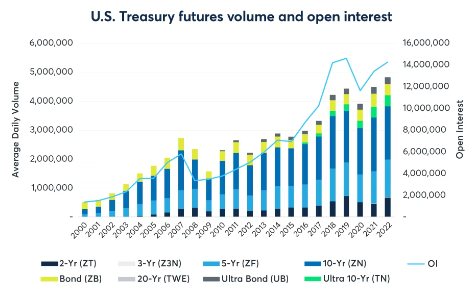

U.S. Treasury futures and options contracts are widely traded for each of the U.S. Treasury benchmark tenors: 2-year, 5-year, 10-year, and 30-year. The short-term bonds are mainly used for fixed income strategy (and its earning curve is like MMF), while traders profit capital gains from long-term treasury bills. Figure below shows trading trends in the UK and the capital gain strategy has gained its popularity.

The Catalysts and Systematic Risks

In the last section, we discussed the bond market and the basic thesis on bond investing. Investment in the bond market also requires understanding the timing and potential risks if the market deicides heading against your trading plans.

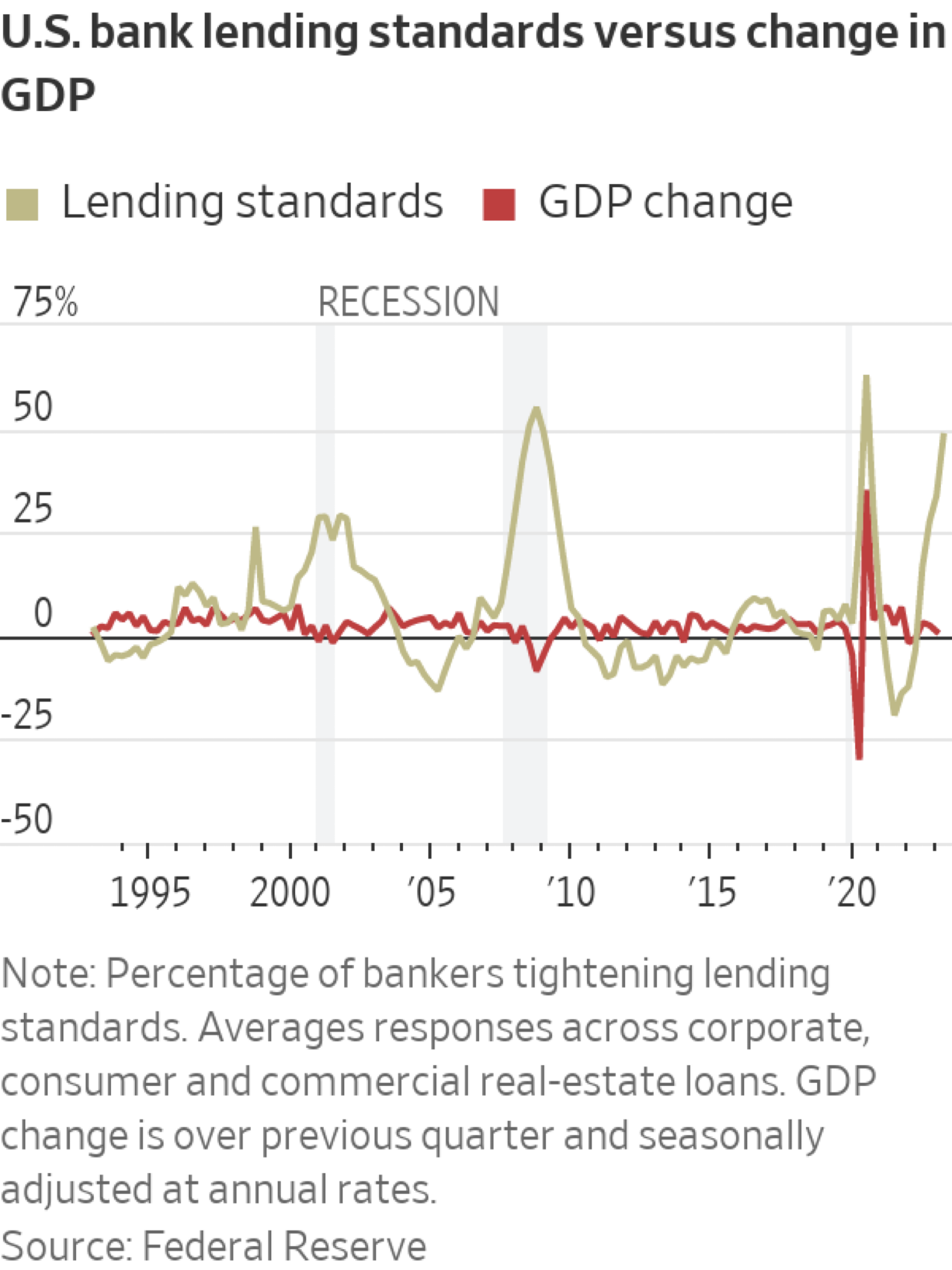

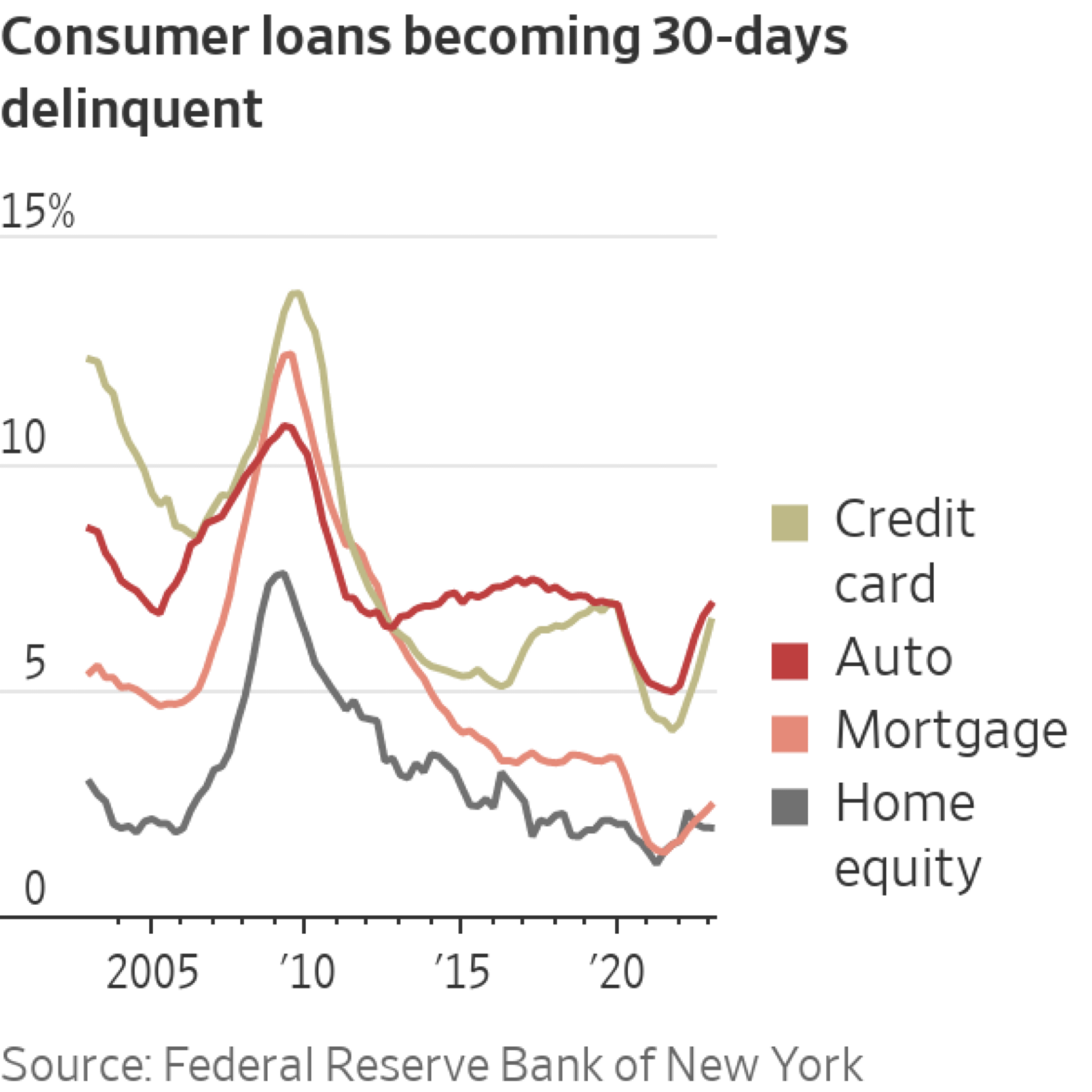

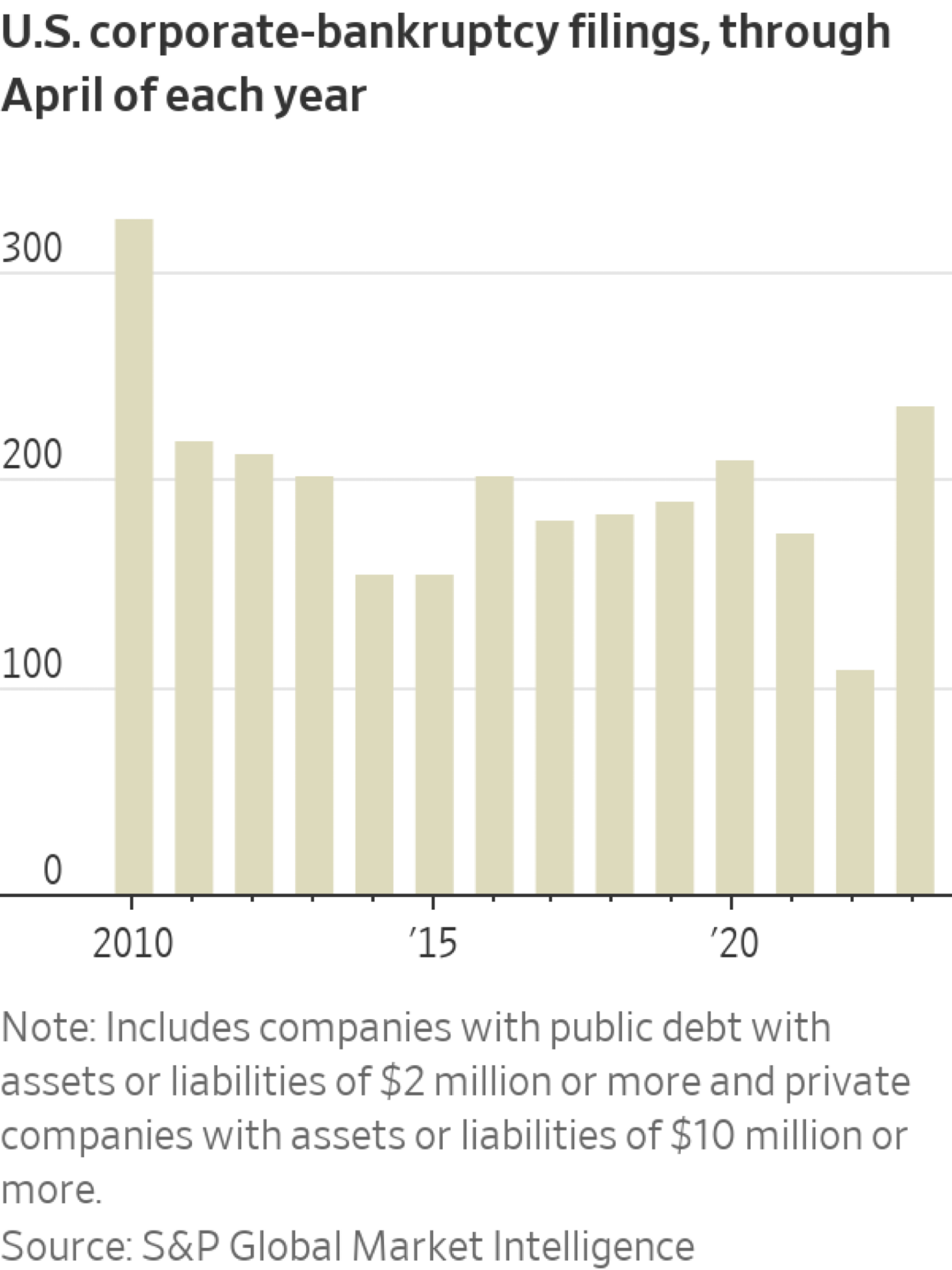

The general economic condition plays an important role in fixed-income product pricing. A slowdown in economic growth or signs of economic uncertainty tends to increase the demand for safe-haven assets like US Treasury bonds. The stability and liquidity of these bonds make them attractive during times of market volatility. If economic indicators suggest a potential downturn or recession, investors may flock to US Treasury bonds as a safe investment, driving up their prices. A recession will also potentially lead to Fed cutting rates to save the capital market, which benefits the bond price.

Therefore, central banks also play a significant role in bond markets through their monetary policies. In times of economic weakness, central banks often implement expansionary monetary policies, such as lowering interest rates and engaging in quantitative easing. These measures can result in increased demand for bonds, including US Treasury bonds, as investors seek higher returns than those offered by other fixed-income assets.

Market dynamics, including supply and demand factors, can influence bond prices. The US Treasury market is the largest and most liquid bond market globally, attracting investors from around the world. If demand for US Treasury bonds outpaces supply, prices can rise. Additionally, the inverse relationship between bond prices and yields means that declining yields, resulting from increased demand, can further fuel bond price appreciation. This is also why we specifically choose 10-year bond notes in the US market.

While a bullish outlook on US 10-Year Treasury bonds is supported by the factors mentioned above, it is crucial to consider potential risks and challenges associated with this strategy.

Interest Rate Risk

Bond prices are sensitive to changes in interest rates. If interest rates rise significantly, the value of existing bonds, including US Treasury bonds, may decline. Therefore, bond traders must carefully monitor interest rate trends and adjust their positions accordingly.

Inflationary Pressures

Inflation erodes the purchasing power of fixed-income investments. If inflationary pressures increase, investors may demand higher yields to compensate for the diminished value of future cash flows. Rising inflation could result in a sell-off of bonds, leading to a decline in prices. Bond traders must assess inflationary trends and their potential impact on bond yields.

Credit Risk

While US Treasury bonds are considered to have minimal credit risk due to the backing of the US government, other types of bonds may carry varying levels of credit risk. Investors must carefully analyse the creditworthiness of issuers and assess the potential for default or downgrades in credit ratings.

Liquidity Risk

In periods of market stress, liquidity in the bond market can dry up, making it difficult to buy or sell bonds at favourable prices. This can result in increased bid-ask spreads and higher transaction costs. Bond traders should consider liquidity risks when formulating their strategies.

Duration Risk

Duration measures the sensitivity of bond prices to changes in interest rates. Bonds with longer durations are more sensitive to interest rate movements. Traders should be mindful of duration risk and its potential impact on their bond portfolios.

Quant

CPI, Bond Yield and Bond Price

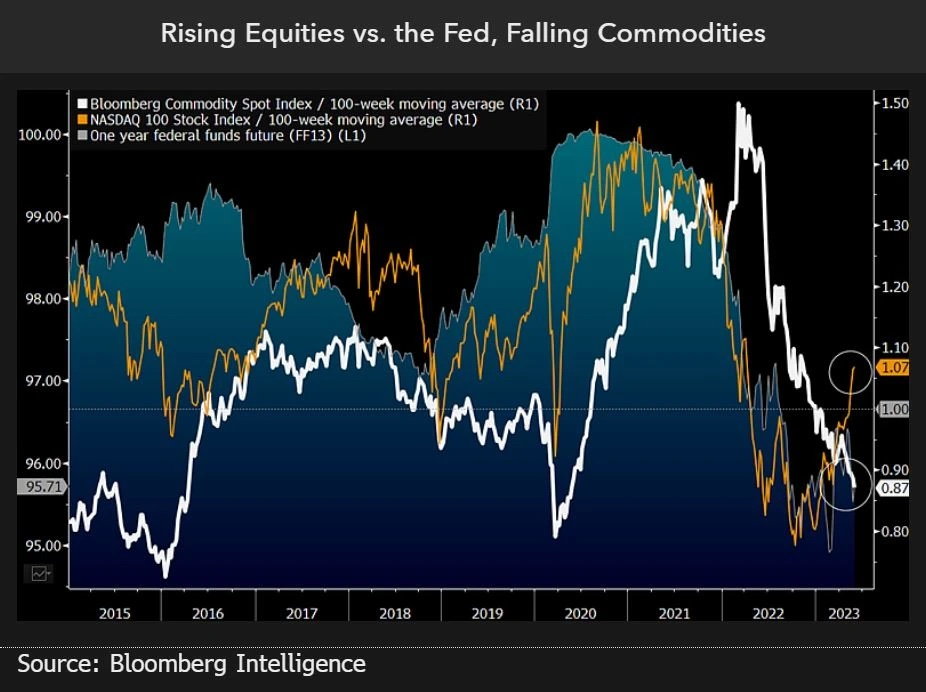

We used BCOM (Bloomberg commodity index), US 10-y T Note and US 10-y rate conducting a correlation analysis, to explain the relationship between inflation/bond price/bond yield.

To calculate the correlation coefficients, we can use the Pearson correlation coefficient formula. Here are the correlation coefficients for the variables:

Correlation coefficient between BCOM (Close) and 10-year rate (Close): 0.7344

Correlation coefficient between BCOM (Close) and 10-year T Note (Close): -0.7984

Correlation coefficient between 10-year rate (Close) and 10-year T Note (Close): - 0.9153

Interpreting the correlation coefficients:

The correlation coefficient between BCOM (Close) and 10-year rate (Close) is approximately 0.7344. This indicates a moderate linear relationship between these variables.

The correlation coefficient between BCOM (Close) and 10-year T Note (Close) is approximately -0.7984. This indicates a moderate negative linear relationship between these variables.

The correlation coefficient between 10-year rate (Close) and 10-year T Note (Close) is approximately -0.9153. This indicates a strong negative linear relationship between these variables.

Please note that correlation coefficients only measure linear relationships and do not imply causation. Additionally, other factors not considered in this analysis may also influence the relationship between these variables.

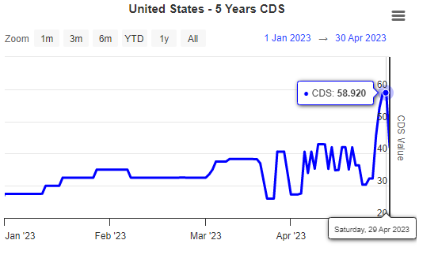

Debt Ceiling

We all know the debt ceiling drama happened recently and when the government reaches this limit, it must seek approval from Congress to raise the debt ceiling and continue borrowing. Failure to increase the debt ceiling can have significant consequences for the economy and financial markets. The US has a long history of increasing the debt ceiling to accommodate its growing borrowing needs.

In 2011, the US government did default on its debts. A prolonged debate over the debt ceiling in 2011 led to Standard & Poor’s downgrading the US credit rating from AAA to AA+, reflecting the potential risks associated with the country’s debt dynamics.

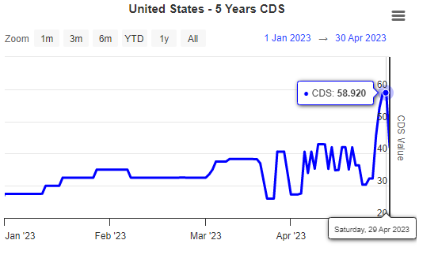

The CDS data shows traders bet on the US defaulting along with the debt ceiling deadline reaching from around 30-40 to 60, which increased over 50% on CDS value. This data reveals a 1.09% implied probability of default, on a 40% recovery rate supposed. In our opinion, apart from the market speculation the US unlikely to default this time.

Trading Strategy

Investing in long-term and short-term Treasury bonds represents different strategies based on the duration of the bond and the investment horizon. Based on different needs and risk preferences, we mainly discuss 3 strategies when trading bonds.

When it comes to retail investors, single directional long-term bonds are recommended, for example, 10-year or 20-year. Long-term bonds have the potential for greater capital appreciation if interest rates decline. When interest rates fall, the prices of existing long-term bonds rise, resulting in capital gains for bondholders. Short-term bonds, on the other hand, are less affected by interest rate changes and are primarily focused on providing a steady income. With 10X leverage longing a 10-year bond is a standard way to capitalise the market volatility.

Short-term bonds offer more stable and predictable income compared to long-term bonds. Investors seeking regular income payments may prefer short-term bonds as they provide more frequent coupon payments and have lower exposure to interest rate fluctuations. Based on the short bond price mean reversion strategy, with higher leverage at 20X to arbitrage could profit in a short period.

Writing CDS is the way shorting defaulting possibility and IV. Based on the previous analysis, with the assumption that the US won’t default, this is the best strategy. Although in most brokers you need at least 100 million dollars to purchase/write CDS.